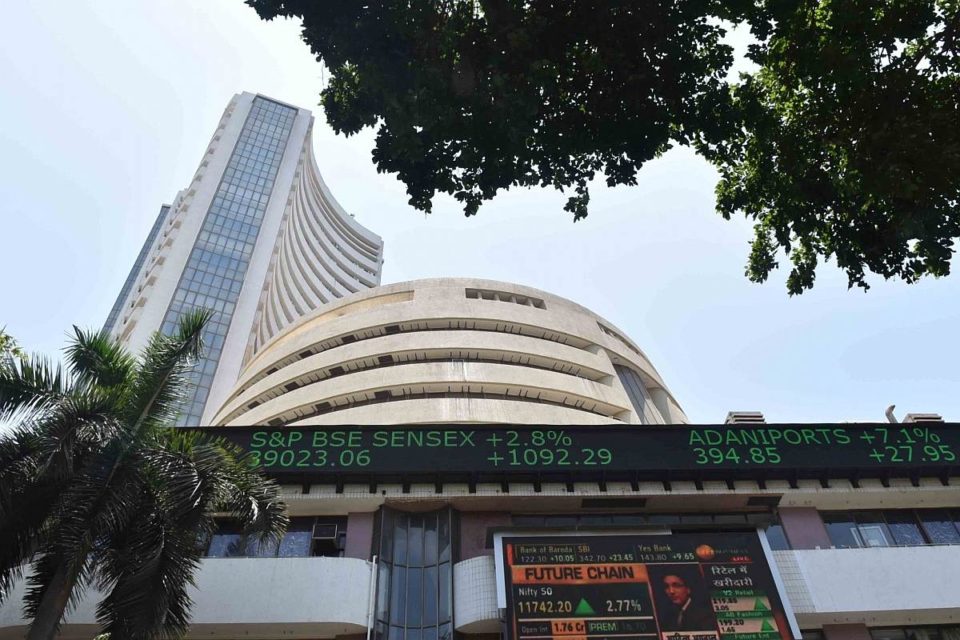

Record highs in Mumbai are stoking the enthusiasm of strategists calling for further upside for Indian stocks, with companies poised to take advantage of a post-pandemic economic recovery in Asia through next year and beyond.

Morgan Stanley, Goldman Sachs Group Inc., and JPMorgan Asset Management are among some prominent names talking up prospects for the country’s shares in recent days. India traders marked Diwali, the Hindu festival of lights, by watching the S&P BSE Sensex Index rally to record highs last week, helped in part by a solid third-quarter earnings season.

“India’s earnings revisions trend has improved sharply and valuations are on the cheaper side of their historical relationship with Asia and emerging markets,” Morgan Stanley strategists including Jonathan Garner wrote in a November 15 note. The firm upgraded its recommendation for the MSCI India Index to overweight, naming it one of the top trades for their 2021 outlook.

Goldman forecasts real economic growth to bounce back strongly over the next two years, fueling a corporate profits rebound of 27 percent in 2021 that’s ahead of its projected 23 per cent increase for the MSCI Asia Pacific ex-Japan Index.

The team expects the NSE Nifty 50 Index to hit 14,100 by the end of next year, implying about a 10 per cent upside from last week’s close.

Looking further ahead, JPMorgan Asset Management projects strong long-term average annualized returns for Indian stocks of 8.9 per cent over the next 10-to-15 years.

“We see broad potential in India from a macro perspective,” said Sylvia Sheng, global strategist with the firm’s multi-asset solutions team in a press briefing last week. Bullish factors include population growth as well as room for productivity to grow, she added.

Signals, Powered By EquityPandit

Signals, Powered By EquityPandit