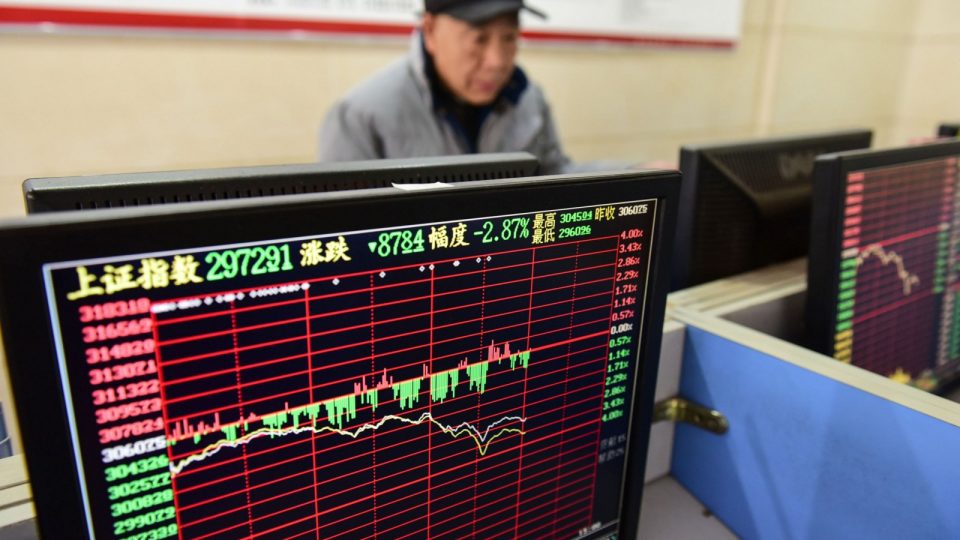

Asian shares rose in early trade on Tuesday after China pledged on Monday to make another effort to boost its economy. At the same time, investors hoped for more clarity ahead of multiple central bank meetings. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.47%, while China’s benchmark CSI 300 and Hang Seng opened 0.2% higher.

Chinese policymakers on Monday reiterated a sense of urgency to take steps to bolster a weakening economy, calling this quarter a critical time for policy action amid evidence of a further loss of economic momentum.

China has also cut the ratio of foreign exchange reserves to prop up the yuan – another sign of unease by the authorities over the yuan’s devaluation.

“Commodities will depend on the impact of China’s stimulus, and success in that will be reflected in major miners,” said John Milroy, investment adviser at Ord Minnett. Australia’s S&P/ASX 200 edged up 0.1% as investors awaited the Reserve Bank of Australia (RBA) meeting later on Tuesday, widely expected to lead to a rise in the cash rate. “The focus today is the RBA,” Milroy said. “Like everyone, we expect the cash rate to rise by 0.5%. However, we also expect and hope we get some comments that they are about to end the upcycle.”

The European Central Bank will meet on Thursday to discuss rate action, followed by the Federal Reserve on September 21. “There is a sense that after the next 75 basis point rate hike in September, there will be a deceleration,” said Sean Darby, head of global strategy at Jefferies in Hong Kong.

E-mini futures for the S&P 500 were up 0.68% in early Asian trade, signalling a good start for Wall Street on Tuesday. US markets were closed Monday for the Labour Day holiday. Japan’s Nikkei 225 fell 0.3%.

European stock indexes fell on Monday, with the euro falling below 99 cents for the first time in 20 years, as European gas prices surged after Russia said its main gas pipeline to Europe would remain closed.

Oil prices fell in early trade on Tuesday, reversing a 3% gain in the previous session, as an October agreement by OPEC+ members to cut output by 100,000 barrels per day was seen as the main symbolic move to stem the market’s recent slide.

Brent crude futures were down 0.47% at $95.29 a barrel by 0149 GMT. However, US crude futures rose 2.44% to $88.99 per barrel. Spot gold rose 0.4% to $1,717.2 an ounce. The dollar index edged down 0.2% after hitting a 20-year high in the previous session.

Signals, Powered By EquityPandit

Signals, Powered By EquityPandit