What is a Demat Account?

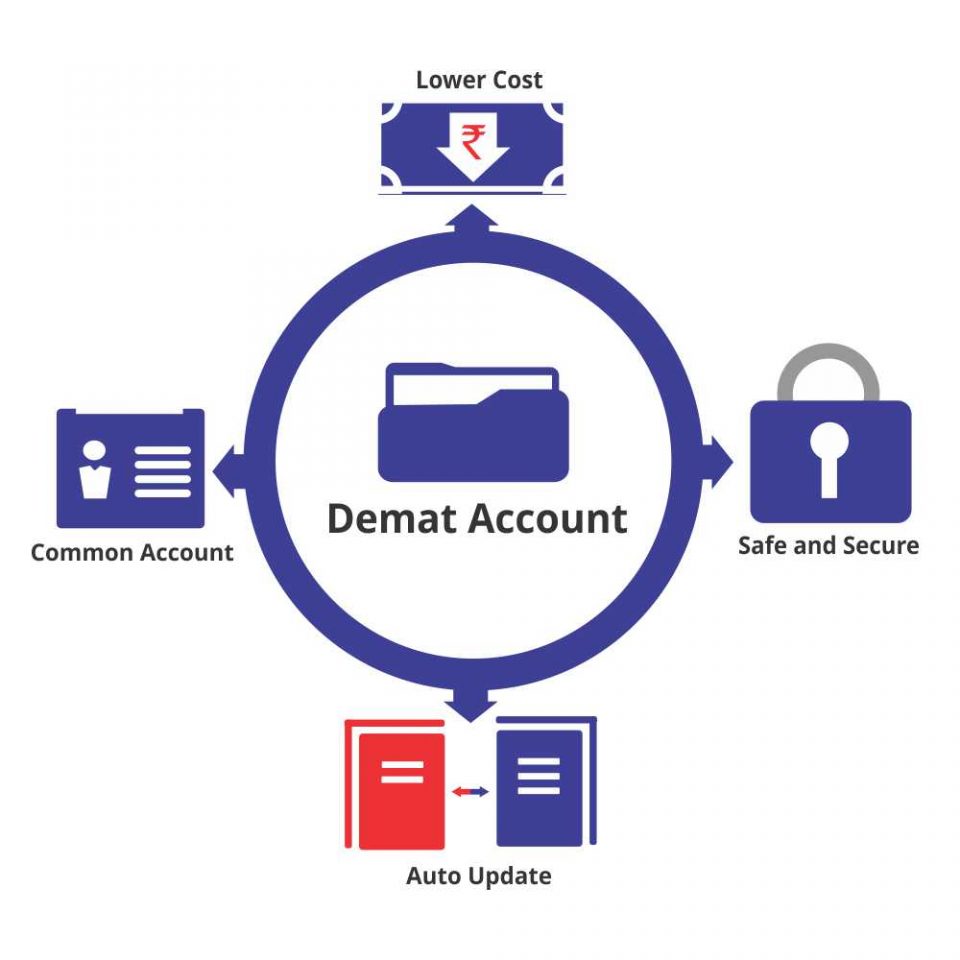

Investing in equity shares in physical form demands a lengthy procedure, so much paperwork, and the risk of getting fake claims. In order to keep the entire experience easy and smooth, a Demat account is required. While trading online, a Demat account is used to hold shares and securities in electronic format. You need a Demat Account number to trade online.

What Are the Documents Required for a Demat Account?

The Demat account opening process and the documents required are similar in many organizations. Here is the detailed list of documents:

A. Proof of Income

You may submit any one of these as proof of income:

● Income Tax Return Acknowledgement slip.

● Certificate of Net Income.

● Salary Slip of the current month.

● Latest statement of the bank account.

B. Proof of Identity

You may submit any one of these as proof of identity:

● PAN card / Aadhaar card / Voter ID card / Driving license/ Passport.

C. Proof of Address

You may submit any one of these as a proof of address:

● Passport/Voters Identity Card/Ration Card/Registered Lease/Driving License/Flat Maintenance Bill/Insurance Copy.

● Telephone bill, electricity bill, or gas bill.

● Bank Passbook.

● Self-declaration of new address given by judges of High Court and Supreme Court.

How to Open a Demat Account?

You can open a Demat Account by following these easy steps:

● Fill in an account opening form and attach a passport-sized photograph in addition to photocopies of the required documents. Remember to carry the original documents for verification.

● The DP will give you a copy of the rules and regulations, the terms of the agreement, and the required charges that you need to pay.

● A representative of the DP would contact you to verify the details provided in the account opening form.

● After processing the application, you will get an account number/ client ID from the DP. These details are required to access the Demat Account online.

● When you become a Demat account holder, you must pay an annual maintenance fee or AMC of your account. Additionally, you would be charged a transaction fee for trading via the Demat Account.

Seven Best Demat Account in India

● Zerodha Demat Account- Zerodha is the biggest and most trusted discount broker with a more than 30 Lakh user base. Zerodha charges a lower brokerage fee of 0.03 per cent or Rs. 20 per trade. Zerodha Demat account opening charges are Rs 200 and AMC Rs 300. The stock delivery trade is free at Zerodha. If you open a Zerodha Account online, you’ll be charged Rs 200, and the Offline by submitting forms is Rs 400.

● Upstox Demat Account- Upstox is another leading discount broker based out of Mumbai. Upstox also charges Rs. 20 per trade. You can save a good amount in brokerages when compared to other full brokers. Upstox Demat and Trading Account Opening are Free for the time being, AMC Rs. 25 per month. They are backed by some of the reputed personalities like Ratan Tata.

● 5Paisa Demat Account- 5Paisa charges the lowest brokerage charges of Rs 10. per trade. 5paisa offers an All-in-one investment account with two different add-on packs

➔ Research & Idea Pack – Rs. 499 per month. Brokerage Rs. 20 per trade and AMC Rs. 45 per month.

➔ Ultra Trader Pack – Rs. 999 per month. Brokerage Rs. 10 per trade and NIL AMC charges.

● Angel Broking Demat Account- Angel Broking is a reputed Demat account provider based in Mumbai. They are pretty popular in providing other services like Mutual funds, Life Insurance. Account Charges of Angel Broking Trading Account are Rs 0, Demat Account Opening Charges Rs 0, AMC Rs. 0 for the first year then Rs. 450 per annum.

● IIFL Demat Account- They have a wide network across major cities of India. IIFL Group Has a client base of more than 40 Lakhs. You can open IIFL Demat account Free along with zero AMC charges for the first year. IIFL Account Opening Charges are free; First-year AMC is free for a limited time, AMC from second-year Rs 250.

● Sharekhan Demat Account- Sharekan is a premium stockbroker established in 2002. Their ‘Trade Tiger’ is one of the advanced trading platforms of India. Sharekhan Trading and Demat Accounts opening charges are Rs 0, AMC for the first year is free, from the second year it is Rs 400.

● Motilal Oswal Demat Account- Motilal Oswal is very popular among retail investors because of its personalized services, customized plans, etc. Motilal Oswal Trading charges are NIL, AMC Charges NIL, Demat Account opening charges NIL, Demat AMC Charges are Rs 441.