Centre may request Hindustan Zinc Ltd (HZL) to deliberate options, besides cash, like share swaps, rights issues, or warrants for the $2.98 billion acquisition of Vedanta’s zinc assets, as per a Mint report. The Centre believes the cash reserves must not be excluded from party-related transactions.

“We comprehend that the company needs to obtain mines to grow its business, but that should not have proceeded through a cash acquisition. There are these other options that the company can implement. The government is an investor or stakeholder in the company and has the right to cash reserves. We will not let them use it for a related-party business deal,” an officer reported to the media.

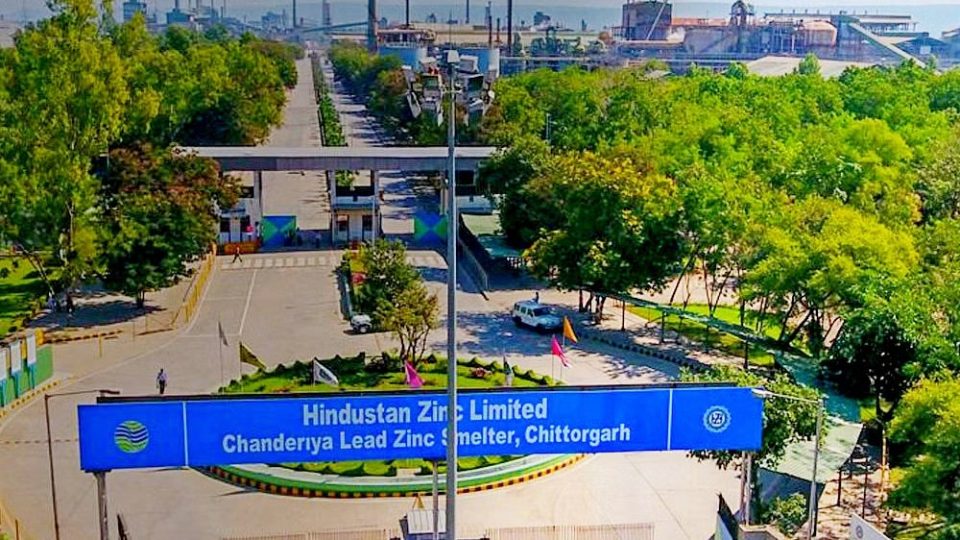

On January 19, the board of HZL permitted the acquisition of zinc assets of THL Zinc Ventures, a subordinate of Vedanta Limited. THL Zinc will convert a wholly owned subsidiary of HZL after the transaction is accomplished. Conferring to the rules of the mines ministry, the deal dishonoured minority stakeholders’ human rights. Vedanta owns a 64.9% stake in HZL, whereas the Centre owns 29.5%.

The report added that the Centre has policies to sell its stake in HZL and has inscribed to the market regulator opposing the deal.

In a recent interview, HZL CEO Arun Misra said that the deal was needed and HZL cannot limit its size and capability to where it is today. India’s annual zinc consumption is 650,000-680,000 tones and is predictable to grow by 3% to 4%. HZL yields 800,000 tons annually. The deal’s sanctions are anticipated to come in the next 18 months.

Signals, Powered By EquityPandit

Signals, Powered By EquityPandit