Have you ever wondered, if the greatest investors existed in the stock markets, “What stocks would they pick?” This question got us wondering about Warren Buffett too. That’s why we have created a list of Buffett’s favorite zone of stocks existing in the Indian market. He has made most of his wealth by investing in monopoly stocks. He refers to these stocks as companies with economic moats. What is a moat? Let’s find out with this example.

Monopoly or Moat?

The definition of monopoly – pure monopoly – is a company that literally has no competition. No other sellers of the particular product or service exist. Such organizations normally have prolonged existence and regular revenue. Monopoly shares have the capacity to turn out to be multibagger shares in the future.

For example, there was a time when Microsoft was the only company in the world that sold software and operating systems for computers, so entities in search of computer-based tools had exactly one option for sourcing these products.

Monopoly stocks in India also known as a ‘Moat’. A Moat is a hole that is built around a castle. It is typically filled with water and intended as a defense against the enemy. The term Moat was popularized by Warren Buffett in the world of investing.

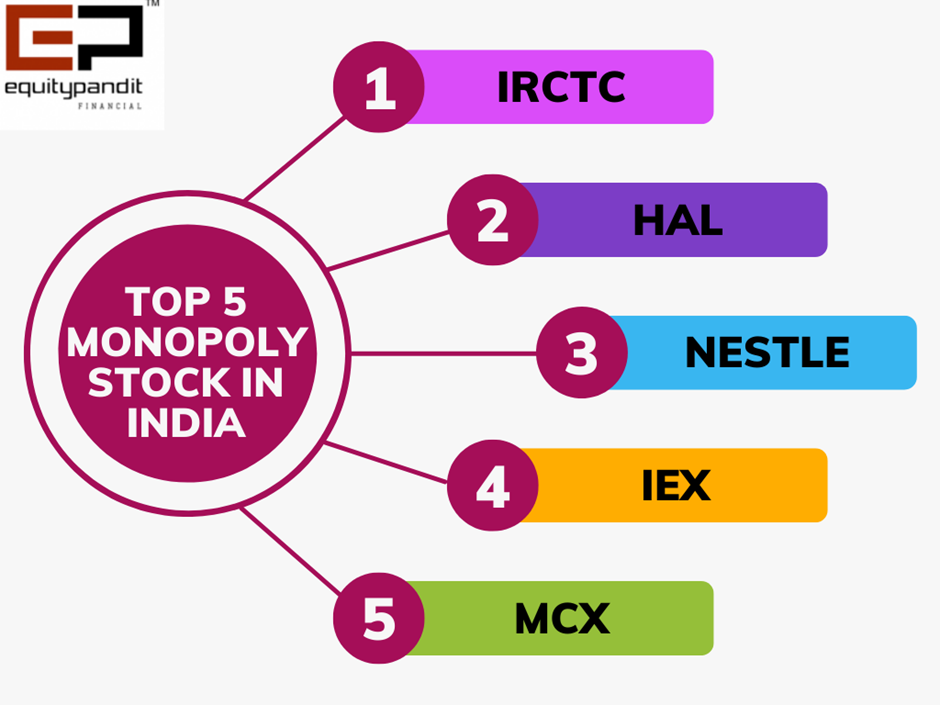

Here’s a look at Top 5 Indian listed companies which enjoy strong monopolies in the market.

IRCTC – 100 % Monopoly

Have you ever travelled in a train except Indian Railways? I guess the answer is No. The Indian Railways have a monopoly in the railway sector. IRCTC is a state-owned enterprise that is the sole player in the Indian market.

HAL- 100% Monopoly

Hindustan Aeronautics Ltd., is another significant monopoly stock in India. The company plays a major role in the whole defense sector. Currently, HAL is majority-owned by the government and is involved in the design, fabrication, and assembly of aero planes, jet engines, helicopters, and other components.

NESTLE – 96.5% Monopoly

Nestle is one of the world’s leading nutrition, health, and wellness companies set up in 1866 in Switzerland. It has spent more than a century in the Indian markets and has become an undisputed market leader in the baby food brand Cerelac. Nestle is the parent company of the top famous brands like Kit Kat , Nestle Coffee, Milkybar, Munch. The most popular Nestle brand is Maggie.

IEX – 95% Monopoly

The Indian Energy Exchange (IEX) is the country’s first and largest electrical exchange, with a market capitalization of over $1 billion. IEX accounts for 95% of the short-term electricity contracts ( less than 1 year) traded over exchanges in India. A virtual monopoly.

MCX – 92% Monopoly

If we talk about the commodity exchanges, there is The Multi Commodity Exchange of India (MCX) that deals in various commodity derivatives and has a monopoly in trading of energy and metals. It has a 100% monopoly in trading precious metals, energy, & base metals. The distant competitor of the company is (NCDEX) with a market share of around 7%.

Conclusion

The stocks listed above are only intended to give you a general picture of what monopoly stocks in India are like. Please make a fundamental and technical research analysis before selecting these stocks for investment.

Signals, Powered By EquityPandit

Signals, Powered By EquityPandit