The MACD (Moving Average Convergence Divergence) indicator is a tool every trader needs to complement his analysis and better decision-making capabilities. A technical power tool for interpreting price movements and momentum changes or potential entry or exit points into the market with respect to finance, it shows the importance of understanding how one can properly employ MACD within a trading system to better distinguish profitable opportunities while managing risk.

In this in-depth guide, we will discuss how the MACD indicator works, how it is calculated, and its practical application in actual real-world trading. We will move on to some of the advanced MACD strategies, determine the strengths and limitations, and provide actionable tips on how to integrate this versatile tool into your current trading framework. Whether you are a novice trader or a seasoned professional, mastering the MACD will take your market analysis to new heights and let you understand better the complexities of price movements.

Understanding the MACD Indicator

The MACD indicator, developed by Gerald Appel in the late 1970s, has stood the test of time as one of the most widely used technical analysis tools in the financial markets. At its core, MACD is a trend-following momentum indicator that reveals the relationship between two exponential moving averages (EMAs) of an asset’s price.

Components of MACD

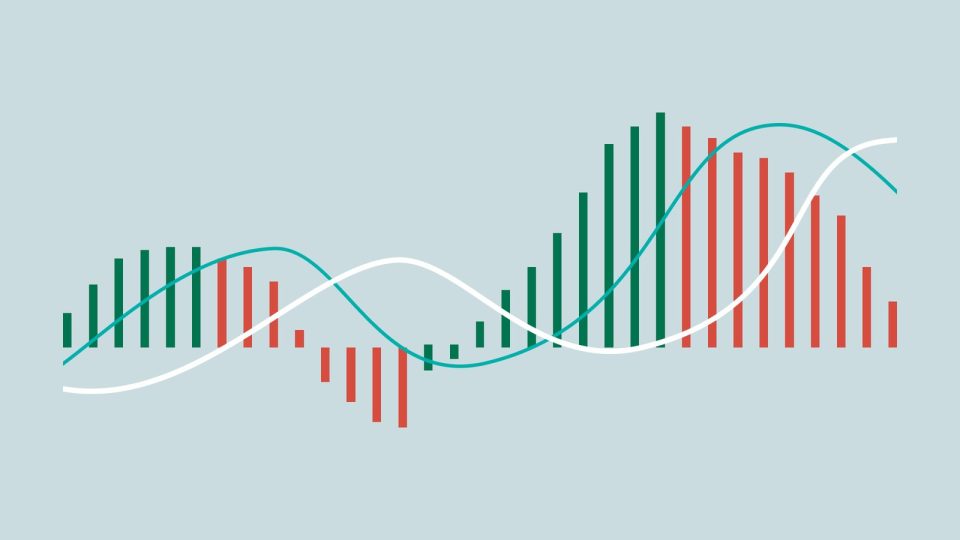

The MACD indicator consists of three key components:

- MACD Line: This is the heart of the indicator, calculated by subtracting the 26-period EMA from the 12-period EMA.

- Signal Line: A 9-period EMA of the MACD line, which acts as a trigger for buy and sell signals.

- MACD Histogram: Represents the difference between the MACD line and the signal line, visualising the convergence and divergence of these two lines.

Calculation Method

The MACD’s calculation involves several steps:

- Compute the 12-period EMA of the asset’s price.

- Calculate the 26-period EMA of the asset’s price.

- Subtract the 26-period EMA from the 12-period EMA to obtain the MACD line.

- Determine the 9-period EMA of the MACD line to create the signal line.

- Subtract the signal line from the MACD line to generate the MACD histogram.

Understanding these components and calculations is crucial for interpreting MACD signals effectively and incorporating them into your trading decisions.

Interpreting MACD Signals

The interpretation of MACD signals requires a subtle understanding of how its different components interact with one other and then relate to the price movements. Recognizing those patterns and relationships enables traders to extract valuable insights for making further market decisions.

Bullish and Bearish Crossovers

One of the most fundamental MACD signals is the crossover between the MACD line and the signal line. When the MACD line crosses above the signal line, it generates a bullish signal, suggesting potential upward momentum. Conversely, when the MACD line crosses below the signal line, it produces a bearish signal, indicating possible downward momentum.

Zero Line Crossings

Another significant aspect of MACD interpretation involves the indicator’s relationship to the zero line. When the MACD line crosses above the zero line, it signifies a shift from bearish to bullish momentum. Alternatively, when the MACD line crosses below the zero line, it suggests a transition from bullish to bearish momentum.

Divergences

MACD divergences occur when the price action of an asset moves in the opposite direction of the MACD indicator. These divergences can be powerful signals of potential trend reversals:

- Bullish Divergence: When the price makes lower lows, but the MACD forms higher lows, it may indicate an upcoming bullish reversal.

- Bearish Divergence: If the price creates higher highs, but the MACD forms lower highs, it could signal an impending bearish reversal.

Understanding these key MACD signals lays the foundation for developing more advanced trading strategies and improving your overall market analysis.

MACD Trading Strategies

Armed with a solid understanding of MACD interpretation, traders can employ various strategies to capitalise on market opportunities. Here are some popular MACD-based trading approaches:

Crossover Strategy

The crossover strategy is one of the most straightforward MACD techniques. Traders enter long positions when the MACD line crosses above the signal line and exit or initiate short positions when the MACD line crosses below the signal line. This strategy works well in trending markets but may generate false signals in choppy or ranging conditions.

Zero Line Bounce Strategy

This strategy bases its trading decision on the interaction of the MACD with the zero line. Traders are looking for the opportunity when the MACD line approaches the zero line from above or below and then bounces off it. A bounce from below might be a good opportunity for a bullish trade, whereas a bounce from above could be a bearish setup.

Divergence Trading

The MACD strategy can be of help in spotting alerts on divergence. If there is a divergence between MACD’s moves and the movement of price, the trader will wonder why the price is doing something different and will probably trade accordingly. They look at bullish divergences to get into long positions and bearish divergences to trade on the short side. It becomes a very effective way of picking up potential turning signs in the trend.

MACD Histogram Strategy

Indeed, some traders concentrate only on the actual histogram to catch the shifting momentum in the strategy of theirs. Should the height of their bars on the histogram go up, the strength of its momentum is solidified, while each descending bar points to weakening of the momentum. This barometer then qualifies the needs of individual traders to fine-tune their entry or exit points within a trend that already exists.

Once such strategies are combined and adapted under the behavior of current market conditions, they provide traders with a strong MACD-based approach tailored according to their unique personal preferences and individual risk capabilities.

Combining MACD with Other Indicators

While MACD is a powerful tool on its own, combining it with other technical indicators can provide a more comprehensive market analysis and help confirm trading signals. Here are some effective indicator combinations:

- MACD and Relative Strength Index (RSI)

- MACD and Moving Averages

- MACD and Bollinger Bands

- MACD and Volume Indicators

By skilfully combining MACD with complementary indicators, traders can develop a more robust analytical framework and increase the reliability of their trading signals.

Risk Management with MACD

Incorporating effective risk management practices is crucial when using MACD in your trading strategy. Here are some key considerations:

- Setting Stop-Loss Orders: Use MACD signals to help determine appropriate stop-loss levels.

- Position Sizing: Adjust your position size based on the strength of MACD signals and overall market conditions.

- Trailing Stops: Implement trailing stops to protect profits and maximise gains.

- Risk-Reward Ratios: Establish favourable risk-reward ratios for each trade based on MACD signals.

By integrating these risk management techniques with your MACD strategy, you can better protect your capital and improve your overall trading performance.

Common MACD Pitfalls and How to Avoid Them

The MACD is a powerful trading tool, but it has limitations that traders must navigate to use it effectively. One common challenge is its tendency to generate false signals in ranging markets, where prices move sideways. To address this, traders can use additional indicators or price action analysis to confirm signals and consider requiring the MACD to stay above or below the zero line before making trades.

Another limitation is the lagging nature of the MACD, as it is a trend-following indicator and may deliver late signals. To reduce lag, traders can use shorter MACD parameters on lower timeframes, though this may increase noise. Combining MACD with leading indicators can provide a more balanced approach.

One more outcome of over-reliance on the MACD as the sole indicator is that one may miss an opportunity or make a lousy trade. Therefore, it should complement a complete trading strategy that forms with different analysis techniques and tools.

The last factor is the false signal from using MACD due to ignorance of the overall market context. Any trader should use MACD only in light of the general market trend, key support and resistance levels, and major economic events that can influence price action.

By learning from these mistakes and adopting countermeasures, the trader will be able to maximise their time spent using MACD, helping improve their decision-making to better their trading outcomes.

MACD in Different Asset Classes

While MACD is commonly associated with stock trading, it can be applied effectively across various asset classes. Understanding how MACD behaves in different markets can help traders adapt their strategies accordingly:

- Forex Trading In the foreign exchange market, MACD can be particularly useful for identifying trend strength and potential reversals.

- Commodity Trading When trading commodities, MACD can help identify cyclical trends and momentum shifts.

- Cryptocurrency Markets In the volatile world of cryptocurrencies, MACD can provide valuable insights and identify underlying trends in crypto assets.

- Options Trading Options traders can leverage MACD for both directional and volatility-based strategies.

By understanding how MACD performs across different asset classes, traders can adapt their strategies to capitalise on the unique characteristics of each market.

Conclusion

The Moving Average Convergence Divergence, or MACD, is one of the most versatile and powerful tools in the modern trader’s arsenal. It provides insights into trend direction, momentum, and potential reversals, making it a valuable tool for informed trading decisions across various financial markets.

We have covered, throughout this exhaustive guide, the fundamental concepts that MACD rests on, methods of calculation, and practical application in real trading scenarios.

As with every technical indicator, it is necessary to remember that MACD should never be used as a standalone component. Successful trading requires a balanced approach combining technical analysis, fundamental research, risk management, and deep insight into market dynamics.

The use of the MACD indicator gives you a critical edge in determining profitable opportunities as well as managing risks in various financial markets. In mastering the use of the MACD indicator, you will improve your skills in how to navigate the complexities of price movements in a more confident and precise manner with time.

Ready to invest like a pro? Unicorn Signals app equips you with 100+ Free tools and knowledge you need to succeed. Download the Unicorn Signals app and gain access to daily stock lists and insightful market analysis and much more!

Live

Live