According to the minutes of the Reserve Bank of India’s August policy meeting, which were made public on Friday, the majority of the committee’s members supported front-loading rate increases to bring inflation within the 2-6 per cent target range and lessen the need for sudden rate rises in the future.

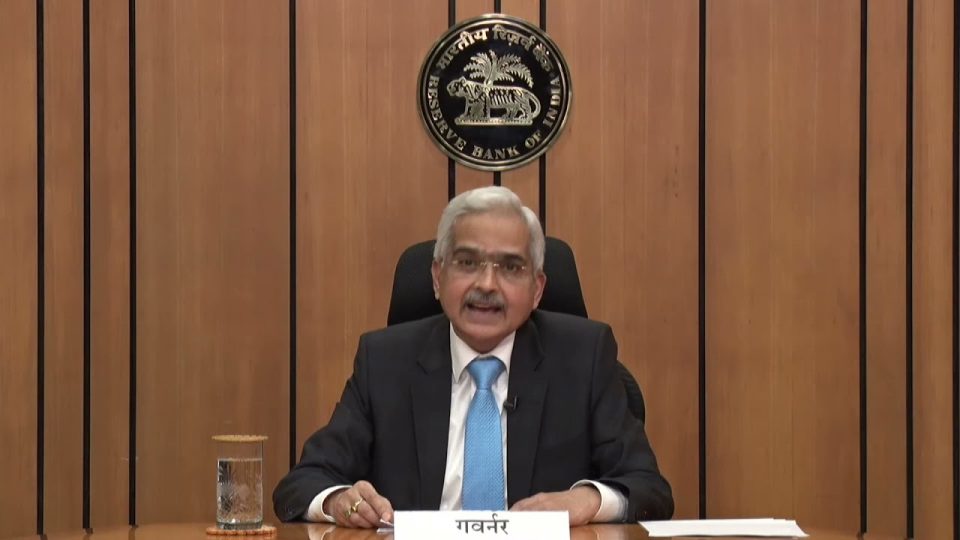

“Actions are aimed towards first lowering inflation within the target zone and then pushing it near to the target of 4 per cent over the medium term while sustaining GDP,” said Governor Shaktikanta Das. Actions will be measured, agile, and calibrated depending on the situation.

The RBI raised the repo rate by 50 basis points to 5.4 per cent on August 5 while maintaining its commitment to withdrawing monetary policy accommodation.

According to MPC member Jayant Varma, the monetary policy committee’s decision should be read as highly likely to more front-loaded tightening.

The lone panellist who opposed keeping the position, Varma, said that the phrase “removal of accommodation” should be “simply” omitted because it indicates that the committee is focused on bringing the repo rate back to 6.5 per cent.

He continued, “In my opinion, the resolution should simply be construed as expressing that there is a high possibility of additional front-loaded tightening without limiting the freedom of MPC to respond to the changing environment in a data-driven manner.

According to MPC member and RBI deputy governor Michael Patra, if monetary policy ignores the second-round impacts of supply shocks through the exchange rate, expectations, etc., the inflation target may be broken for an extended time. Thus, he claimed that front-loading rate measures would show RBI’s dedication to the 4 per cent inflation target.

Signals, Powered By EquityPandit

Signals, Powered By EquityPandit