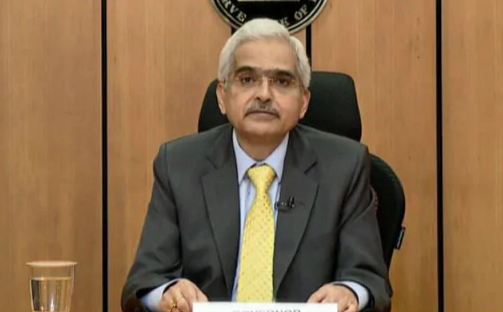

Governor of Reserve Bank of India Shaktikanta Das-led Monetary Policy Committee decided to hold key policy rates unchanged at existing levels on Friday amid high inflation. The status quo on interest rate – a second in a scheduled review – was in line with economists’ expectations. The RBI said it will continue with its “accommodative” stance of policy to help pull the coronavirus-ravaged economy out of its worst slump on record. The monetary policy panel kept the repo rate – the key interest rate at which the RBI lends funds to commercial banks – at 4.0 per cent and the reverse repo rate – or the key borrowing rate – at 3.35 per cent. Three new external members in the panel voted in today’s decision.

The RBI sees the country’s real GDP contracting by 9.5 per cent in the current fiscal year, Mr Das said in a webcast after the MPC meeting. The economy has been the worst hit by the pandemic among major countries and new infections continue to climb, but the RBI Governor said there were some encouraging signs of a business turnaround and activity could return to growth in the January-March quarter.

Here are the Key points of RBI’s latest monetary policy update:

- MPC Votes Unanimously To Hold Key Policy Rates

- RBI Holds Key Policy Rates At Existing Levels As Expected

- Sensex, Nifty Mildly Up Before RBI Policy Decision; Financial Stocks Rise

- MPC’s 3 New Members To Vote In Today’s Decision

- RBI Widely Expected To Hold Policy Rates

- MPC Decision On Rates To Be Out Soon