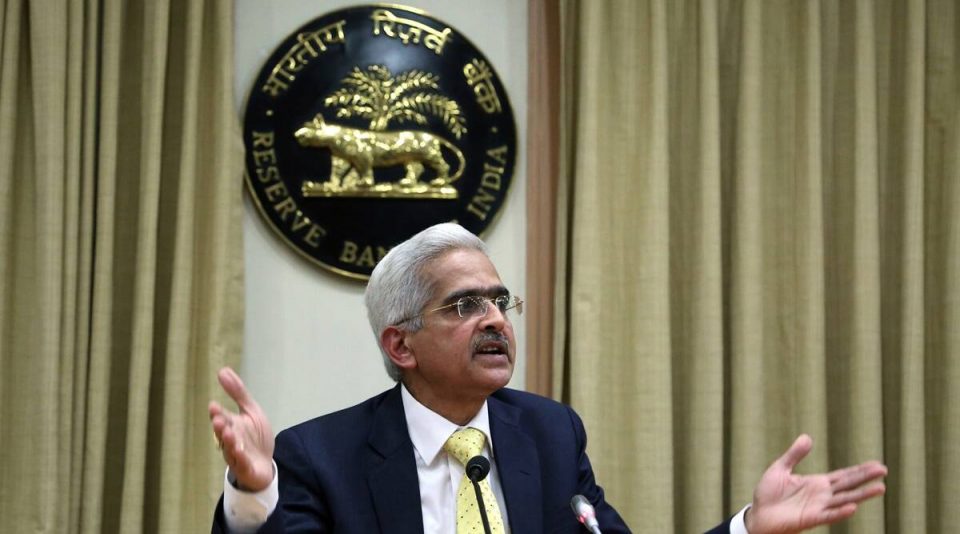

Reserve Bank of India (RBI) has kept the policy rate unchanged at 4 per cent and voted unanimously to maintain the status quo with an accommodative stance. The reverse repo rate remained unchanged at 3.5 per cent, and the marginal standing facility and bank rate kept unchanged at 4.25 per cent. Most of the experts and analysts expected RBI to maintain the status quo amid rising COVID-19 cases in the country. It may be noted that the RBI had kept the key interest rate (repo) unchanged for the fifth consecutive meeting. “If patience is worth anything, it must endure to the end of time. And a living faith will last in the midst of the blackest storm,” RBI Governor Shaktikanta Das said while concluding the MPC.

The first RBI policy of FY’22 with its continued accommodative stance to maintain liquidity surplus in the market can be viewed as being pragmatic. Though the RBI moves away from time-based guidance, it has prudently provided timelines to its liquidity-focused measures providing cushioning to the financial markets. The equity markets will cheer with the announcement on RBI’s Government Securities Acquisition Programme. This will ensure government borrowing at a low cost and be able to address pandemic-related adversities from both economic and healthcare aspects. Last year, the RBI had rejected a resolution plan by an ARC for a telecom company. In the distressed asset market, the investors have few tools to optimize their investment and participate in the resolution of NPAs. This move of the RBI created confusion in the market by endorsing an interpretation of the SARFESI Act that ARCs cannot invest in equity

Signals, Powered By EquityPandit

Signals, Powered By EquityPandit