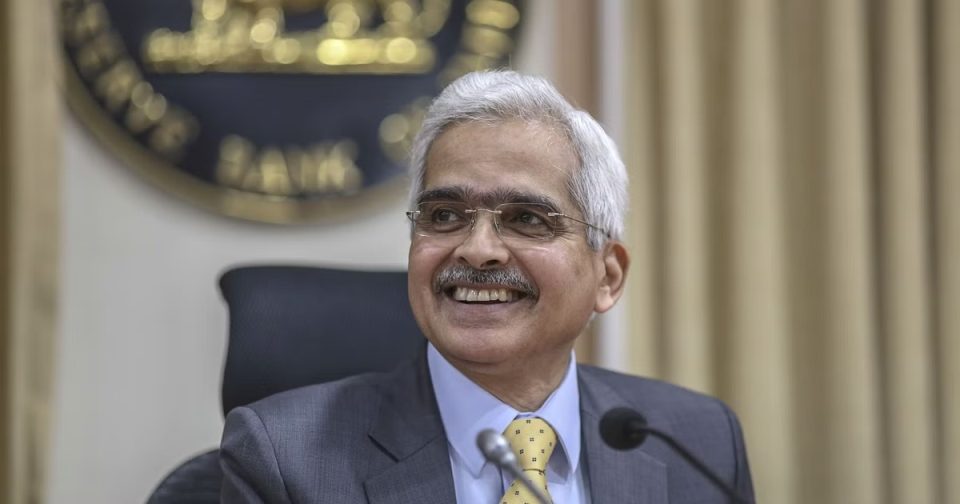

On Thursday, the Reserve Bank of India (RBI) Monetary Policy Committee (MPC) announced its decision not to raise the repo rate. In announcing the decision, RBI governor Shaktikanta Das said the MPC took the decision unanimously.

“The Monetary Policy Committee unanimously decided to keep the policy change unchanged at 6.5%,” Das said.

“The MPC’s cumulative rate hike of 250 basis points is being transmitted through the economy, and its broader impact should keep inflationary pressures in the coming months. Monetary policy must be carefully adjusted to align inflation with the target. Against this backdrop, The Monetary Policy Committee decided to keep the policy repo rate unchanged at 6.5%,” he said.

Das added that the Monetary Policy Committee decided by a five-out-of-six majority to continue its “withdrawal of accommodation” stance. “Jayanth R Varma expressed reservations about this part of the resolution,” he said.

He also added that the Monetary Policy Committee will take further decisions “as and when required”.

The committee also left its gross domestic product (GDP) growth forecast unchanged at 6.5% for FY24. The forecast remains at 8% for the first quarter (Q1), 6.5% for the second quarter, 6% for the third quarter and 5.7% for the fourth quarter.

Also, the Monetary Policy Committee decided to lower its inflation forecast for the fiscal year 2023-24 (FY24) to 5.1% from 5.2% previously. Inflation is expected to remain above 5% throughout FY24, Das said.

“Headline inflation is projected to decline in 2023-24 from 2022-23 levels but remains above target, and warrants continued vigilance,” he said.

“The objective is to achieve the 4% target inflation rate going forward, and our monetary policy actions are producing the expected results, which gives us room to keep rates on hold at this meeting,” Das added.

In his speech, Das said India’s foreign exchange reserves stood at $595.1 billion on June 2. In addition, the current account deficit is expected to moderate further in the last quarter of the previous financial year, and FY24 “should be very manageable”.

The RBI hiked the repo rate by 250 basis points to 6.5% between May 2022 and February 2023. In April 2023, the Monetary Policy Committee pressed the pause button on interest rate hikes. RBI Governor Shaktikanta Das stressed that this is a pause, not a pivot while leaving the possibility of further tightening open.

According to the RBI, inflation based on the consumer price index (CPI) – the main gauge of monetary policymaking fell to an 18-month low of 4.7% y/y in April (from 5.7% y/y in March). Within the target range of 2-6%.

In its last policy announcement in April, the MPC suspended repo rate hikes. In his speech, while keeping the key rate at 6.5%, Das said it was a “pause, not a pivot”. The pause came after six straight hikes.

The MPC also decided by a five-to-one majority to remain focused on removing accommodation to ensure that inflation is gradually aligned with the target while supporting growth.

Signals, Powered By EquityPandit

Signals, Powered By EquityPandit