On Friday, the Reserve Bank of India (RBI) decided to hike in policy repo rate by another 50 basis points (bps) to 5.4%. As per the RBI guideline, banks have a plan to reset the rate of interest on the loan which is linked to external benchmarks at least once every quarter.

Latest loans on the repo-linked benchmark would see the impact of the rate hike from the next due date for equated monthly installments (EMIs). MCLR is an internal benchmark and will take a bit longer to revise the price. Banks benchmark retail and small business loans to external rates, while most corporate loans are pegged to their MCLRs. With a hike in interest rates are up by a cumulative 140 basis points since May.

- IREDA Shares Skyrocketed 11% on Receiving Navratna Status

- Glenmark Pharma Shares Gain 1% on Receiving USFDA Approval

- Stocks Under F&O Ban: Vodafone Idea

- Stocks in Focus: Vodafone Idea, Maruti Suzuki, ICICI Bank, and Others

- Vedanta Outlook for the Week (April 29, 2024 – May 03, 2024)

On 2 August, Shanti Ekambaram who is the whole-time director-designate of Kotak Mahindra Bank said in an interview the bank was continuing to see demand, unimpacted by the rate hikes. Ekambaram said any postponement of purchase is normally not linked to interest rates, but factors like property prices, jobs and transfers.

Loan Distribution’s V Swaminathan said: “Such lending rate adjustments by the RBI could signal a downward trend for borrowers seeking home loans as EMIs on both new and existing home loans rise, triggering a wait-and-see attitude among new home buyers.” Executive Chairman of Andromeda Lending Company.

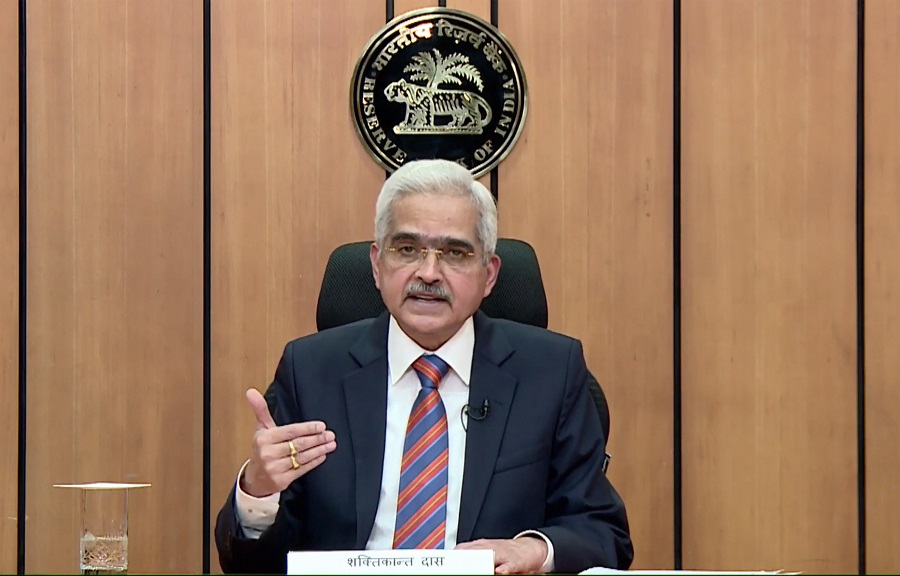

That said, depositors stand to benefit as those rates are set to rise as well. RBI governor Shaktikanta Das said on Friday that quite several banks have already increased their deposit rates in recent weeks and said he expects the trend to continue. Das said that banks need to have deposits to support credit demand, and cannot rely on central bank funds on a perpetual basis.

Signals, Powered By EquityPandit

Signals, Powered By EquityPandit