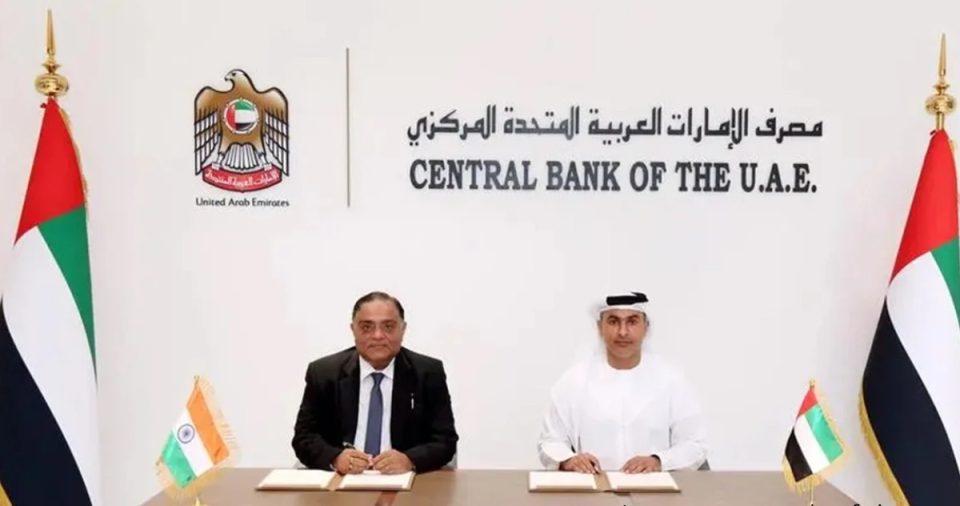

The Reserve Bank of India (RBI) and the Central Bank of the United Arab Emirates (CBUAE) have signed an MoU on financial product innovation in Abu Dhabi to strengthen cooperation and jointly drive innovation in financial products and services.

Under the MoU, the two central banks will collaborate in various emerging areas of fintech, particularly central bank digital currency (CBDC), and explore interoperability between CBUAE and RBI’s CBDC. According to the RBI statement, the CBUAE and RBI will jointly conduct a proof-of-concept (PoC) and pilot a bilateral CBDC bridge to facilitate cross-border CBDC remittance and trade transactions.

This bilateral engagement in testing cross-border use cases of CBDC is expected to reduce costs, improve the efficiency of cross-border transactions and further strengthen economic ties between India and the UAE, the Reserve Bank of India said on Wednesday. The MoU provides technical cooperation and knowledge sharing on fintech and financial products and services.

Last month, RBI Deputy Governor T Sankar Rabi said eight banks were involved in the central bank’s digital currency project launched on February 8.

The deputy governor said that the pilot project currently covers five cities: Mumbai, New Delhi, Bangalore, Bhubaneshwar and Chandigarh. The RBI launched the first digital rupee pilot on December 1, 2022.

Under the theme of the Indian Presidency’ One Planet, One Family, One Future’, G20 finance ministers and central bank governors met in Bengaluru on 24-25 February to work on strengthening international policy cooperation to steer the global economy Towards ensuring strong, sustainable, balanced and inclusive growth.

According to the G20 Chairman’s Summary and Outcome Document Statement issued by G20 members on February 25, members stated that they would continue to explore the macro-financial implications of the potential introduction and widespread adoption of central bank digital currencies (CBDCs), as well as their impact on cross-border payments and international monetary and financial system.

Signals, Powered By EquityPandit

Signals, Powered By EquityPandit