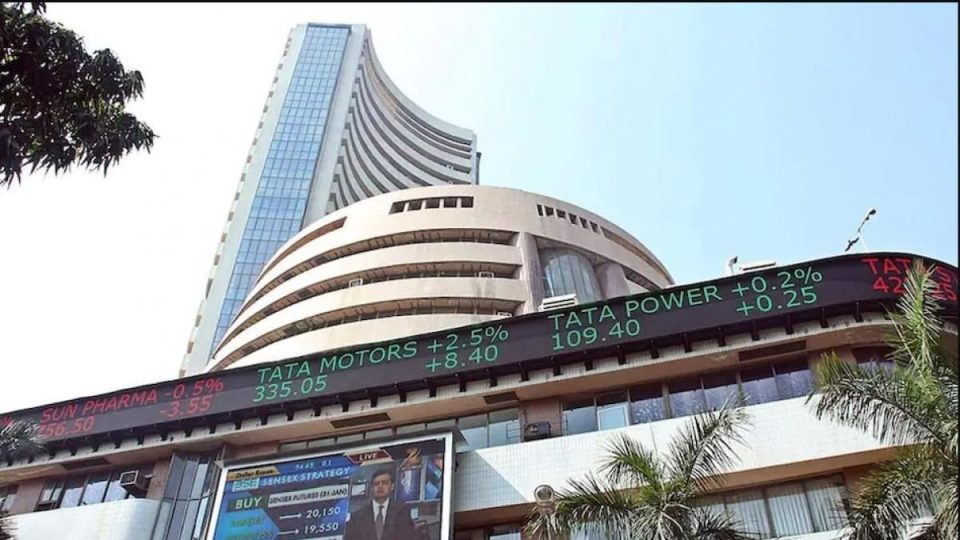

India’s benchmark stock index fell for the sixth session on September 28, weighed down by banks, financials and metals companies amid weak global signals.

At 10.28 am, the Sensex closed at 56,851.62, down 255.9 points or 0.45%, while the Nifty50 lost 60.85 points, or 0.36%, to settle at 16,946.55, below the psychological level of 17,000.

V K Vijayakumar, the chief investment strategist at Geojit Financial Services, blamed the bearish global trend, with the Nasdaq down 33.2% from its peak and the S&P 500 down 24.3%. The Euro Stoxx 50 is down 24.3% from its peak. These are clear bearish signals from developed markets. India is a clear outlier, down just 8.5% from the Nifty’s peak. He added that India can stay ahead with its strong fundamentals but cannot be immune to major global trends.

On Tuesday, the S&P 500 fell to its lowest level in nearly two years on fears of an extremely aggressive Fed tightening, trading below June lows and allowing investors to assess how much more stocks had to fall to stabilise.

The S&P 500 hit a session low of 3,623.29, its weakest session low since November 30, 2020. A late rebound helped the index off its lowest level of the day, but it closed lower for a sixth straight session, down 7.75 points, or 0.21%, to 3,647.29.

Among Asian stocks, the Nikkei and Korea Kospi were down more than 2% each, while the SGX Nifty lost more than 1% or 192 points to 16,846.

The rupee fell to a fresh low of 81.90 against the dollar amid rising US bond yields and a stronger dollar. The dollar hit a fresh two-year high against a basket of currencies on Wednesday as US Treasury yields rose, while the pound sank to near record lows on fears that Britain will cut taxes more deeply to stimulate the economy. The dollar index hit a new high of 114.68 in Asian trade and was last up 0.42% at 114.62. Meanwhile, the yield on the benchmark US 10-year Treasury note rose to 4% for the first time since 2010, reaching as high as 4.004%. According to Reuters, the two-year yield was 4.2912%.

Signals, Powered By EquityPandit

Signals, Powered By EquityPandit