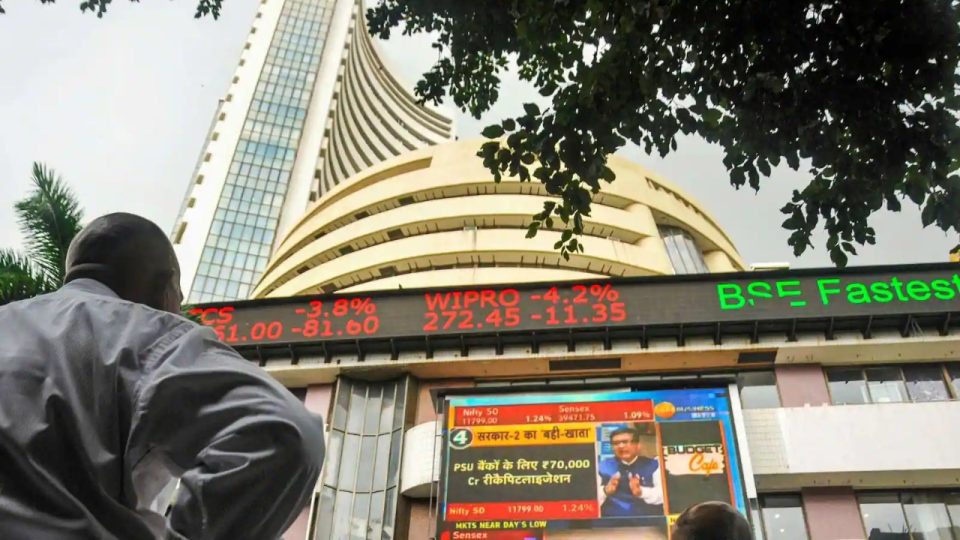

Bulls faltered on Dalal Street on strong global cues and a weaker dollar. Benchmark indices opened sharply higher. The NSE Nifty50 rose more than 200 points to trade above the 18250 level, and the BSE Sensex rose more than 900 points to reclaim the 61,500 mark.

The broader market rose in tandem as the Nifty MidCap 100 and Nifty SmallCap 100 indexes rose more than 1%. The Nifty IT index rose more than 2%, with all sectors trading in the green stable.

Japan’s Nikkei 225 rose more than 2% in early trade, while South Korea’s Kospi rose more than 3%. In the US, the S&P 500 gained 5.54%, the Nasdaq gained 7.35%, and the Dow Jones Industrial Average rose 3.7% on Thursday.

DCX Systems stock will be listed on the exchange today. According to information on the BSE website, DCX Systems’ IPO listing date has been set for November 11, 2022, meaning DCX shares will debut on the secondary market today. According to stock market experts, shares of DCX Systems are likely to trade strongly, with DCX Systems shares likely to open in the range of Rs 275 to Rs 300 per share.

“The issue has been well-received by institutional and retail investors, with a current GMP of 70, or about 32% above its offering price. We advise investors to lock in the listing proceeds, and only aggressive investors should consider investing in the company. Make a long-term commitment,” said Pravesh Gour, senior technical analyst at Swastika Investmart Ltd.

Tech Mahindra, Wipro, Infosys, HCL Technologies and Apollo Hospitals were the main winners for Nifty, while Eicher Motors and Hero MotoCorp were the losers.

The Sensex gained 827.54 points or 1.37% to 61441.24, and the Nifty gained 241.00 points or 1.34% to 18269.20. The gap between India’s benchmark and the Nifty index widened to more than 18,250 points after a positive global signal amid slowing US inflation.

Asian stocks soared, while the dollar fell sharply after US consumer prices rose less than expected, raising hopes that the Federal Reserve may slow the pace of aggressive interest rate hikes. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 3.72%. Australia’s S&P/ASX 200 gained 2.43%, while Japan’s Nikkei gained 3%.

Benchmark indices surged ahead of the open. Sensex surged 700 points, while Nifty surged 240 points or 1.35% above 18,250. The Indian rupee opened at a seven-week high of 80.68 against the dollar. It was up 113 paise from Thursday’s close of 81.81.

The Indian rupee is expected to appreciate against the US dollar amid rising equity market risks on Friday. The local currency will likely gain on a weaker dollar amid weaker-than-expected US inflation data. Today, the focus will be on UK GDP data, likely to rise sharply against the US dollar. The rupee weakened against the dollar in the previous session as participants remained cautious ahead of US inflation data. Weak trends in the domestic stock market also weighed on investor sentiment. In the inter-bank foreign exchange market, the local currency opened at 81.61 and closed at 81.77, down 30 paise from the previous closing price.

Signals, Powered By EquityPandit

Signals, Powered By EquityPandit