Hindenburg Research, the short investor whose reports on companies have wiped a large portion of their value, criticised Icahn Enterprises LP (IEP) on Tuesday for its financial reporting, resulting in a 20% decrease in the activist investor Carl Icahn’s business’s shares.

In the series of targeting high-profile organisations, IEP is Hindenburg’s latest short bet. It went after India’s Adani Group earlier this year, knocking over $100 billion in value off the conglomerate’s shares.

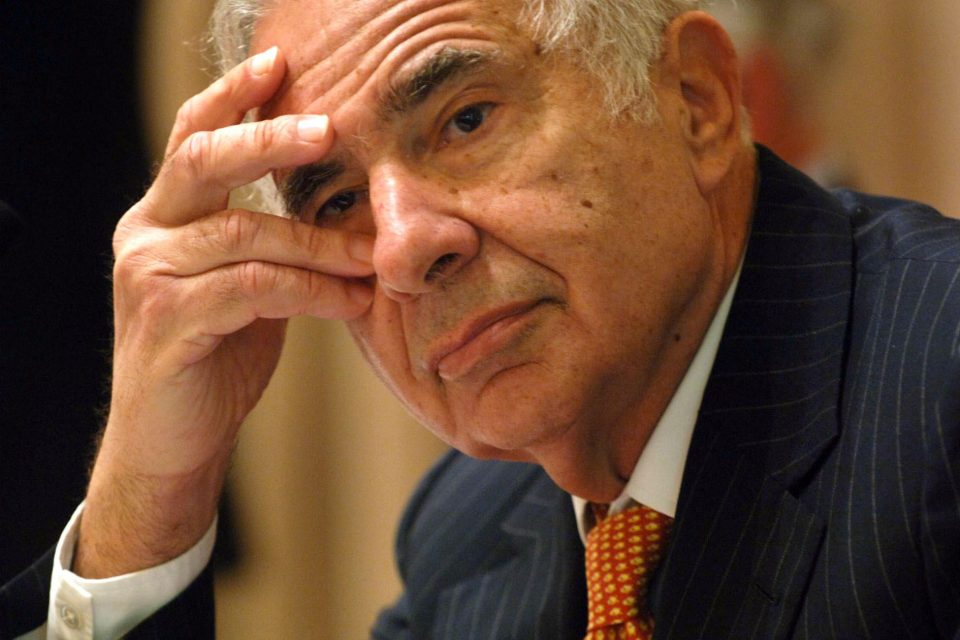

The development represents a unique test for Icahn, who is used to criticising firms’ governance and transparency as one of the founders of shareholder activism but has never faced such scrutiny himself.

Hindenburg, in a report released on Tuesday, accused IEP of overvaluing its stocks and relying on a “Ponzi-like” structure to pay dividends in a report released on Tuesday. According to Bloomberg, the ensuing drop in IEP shares took $2.9 billion off Icahn’s net worth, leaving him with an estimated $14.7 billion.

In response, an IEP statement was declared wherein Carl accused Hindenburg of generating profits at the expense of IEP’s long-term shareholders through the “self-serving” report.

“We stand by our public disclosures, and we believe that IEP’s performance will speak for itself over the long term as it always has,” Icahn said.

Icahn has several investments in the energy, automotive, food packaging, and real estate industries under a Florida-based company, Sunny Isles Beach. He has a controlling stake of 85% in IEP.

According to Hindenburg, “IEP trades at a 218% premium to its last reported net asset value (NAV),” whereas its competitors, Dan Loeb’s Third Point Investors Ltd and Bill Ackman’s Pershing Square Holdings Ltd, trade at a discount to their respective NAVs.

The dividend yield of 15.8%, the highest of any U.S. large-cap firm by far, is driving the frothiness in IEP’s shares. Hindenburg accused Icahn of taking money from new investors and paying it as dividends to new investors. Icahn, as per Hindenburg, inflates the dividend yield by collecting his own dividend in stock rather than cash and forcing IEP to sell the new stock to fulfil shareholder distributions.

Hindenburg also provided examples that they claimed demonstrated IEP was overvaluing its holdings. IEP valued its 90% interest in meat-packaging company Viskase Companies Inc at $243 million versus its actual valuation of only $89 million.

In another case, IEP valued its automotive components division at $381 million in December 2022, just one month before a key subsidiary declared bankruptcy.

Hindenburg also criticised the close ties between Jefferies Inc and Icahn. The short seller pointed out that Jefferies, the only major brokerage firm that covers IEP, assumes in its equities research that Icahn’s dividends will be paid in perpetuity even in the worst-case scenario while profiting from orchestrating IEP stock sales.