What is the MSCI World Index?

The MSCI All Country World Index measures the performance of both developed and emerging markets and includes almost 3,000 stocks from 47 markets across the world.

MSCI, short form for Morgan Stanley Capital International, is a company that provides investment data and analytics services. It was established in 1986 when Morgan Stanley acquired the licensing rights to data from Capital International.

MSCI is well-known for its stock indexes, which are used by mutual funds, ETFs, and individual investors as market benchmarks. These indexes track different sectors of the global economy, including emerging, frontier, developed, and global markets.

What is the MSCI India Index?

Morgan Stanley Capital International (MSCI) has set up many global indices, one of which is a composite of Indian stocks MSCI India index. Many reputed Indian companies across sectors are included in the index. These companies amount to at least 85% of the total equity offered by Indian companies. The index includes 10 major sectors of the economy such as IT, finance, and energy sectors. There are 64 companies listed on the MSCI India index, as of May 2015.

India’s influence in the MSCI’s Global Standard index, which monitors stocks in emerging markets, has reached a new peak, indicating the potential for increased investment in its stock market.

Please click on the link – MSCI India Index Data as of May 10, 2024, to know more.

India vs China’s weight in the MSCI Index

India’s weight in the index has risen to 19%, narrowing the gap with China, whose weight will decrease to 25% from 25.4%. These changes, announced on Wednesday, will take effect on May 31.

Following the May adjustments, India’s stock count in the MSCI Global Standard index will reach 149, the highest ever for the country.

India’s growing prominence in emerging markets is attributed to the strong performance of its equities, particularly in the mid-cap segment, while other emerging markets, especially China, have underperformed.

Rearrangements (rejig) in the MSCI India’s securities

India’s representation in the MSCI Emerging Markets Index is set to increase from 18.3% to closer to 19%, making it the highest increase in weight in terms of basis points among any EM Index in this rejig. This will lead to possible Foreign Institutional Investment (FII) inflows worth about USD 2.5 billion.

MSCI updated its Global Standard Index on May 15, 2024, by adding 13 new stocks. It includes Canara Bank, JSW Energy, NHPC, Indus Towers, Phoenix Mills, PB Fintech, Sundaram Finance, Bosch, Jindal Stainless, Solar Industries, Torrent Power, Mankind Pharma, and Thermax. These additions are expected to attract more investment into these stocks.

| Serial No. | Securities Name | Market Capitalisation as of May 15, 2024 (INR in crores) | CAGR of last 3 years (in %) | Sector Name |

| 1. | Canara Bank | 1,07,998 | 57% | Banks, PSU |

| 2. | JSW Energy | 1,04,456 | 74% | Power Generation & Distribution |

| 3. | NHPC | 97,829 | 56% | Power Generation & Distribution |

| 4. | Indus Towers | 92,113 | 12% | Telecomm Equipment & Infra Services |

| 5. | Phoenix Mills | 52,469 | 59% | Realty |

| 6. | PB Fintech | 57,473 | N/A | IT – Software |

| 7. | Sundaram Finance | 52,639 | 26% | Finance |

| 8. | Bosch | 91,326 | 31% | Auto Ancillaries |

| 9. | Jindal Stainless | 56,421 | 95% | Steel |

| 10. | Solar Industries | 75,589 | 90% | Aerospace & Defence |

| 11. | Torrent Power | 65,571 | 47% | Power Generation & Distribution |

| 12. | Mankind Pharma | 87,990 | N/A | Pharmaceuticals |

| 13. | Thermax | 60,490 | 54% | Capital Goods-Non-Electrical Equipment |

Conversely, three stocks were removed from the index: Berger Paints, Indraprastha Gas, and Paytm.

| Serial No. | Securities Name | Market Capitalisation as of May 15, 2024 (INR in crores) | CAGR of last 3 years (in %) | Sector Name |

| 1. | Berger Paints | 56,681 | -8% | Paints/Varnish |

| 2. | Indraprastha Gas | 30,755 | -5% | Gas Distribution |

| 3. | Paytm (One 97 Communications Ltd) | 21,843 | N/A | E-Commerce/App based Aggregator |

MSCI is a top provider of equity, fixed income, and hedge fund indices globally. The MSCI Global Standard Index is widely used by institutional investors such as mutual funds, exchange-traded funds, and pension funds to track their investments.

The weights of certain stocks within the index have also changed. Notable increases were seen in YES Bank, Zomato, Vedanta, AU Small Finance Bank, Macrotech Developers, Polycab India, Samvardhana Motherson, and Suzlon Energy. These rearrangements are expected to attract more investment into these stocks.

| Serial No. | Securities Name | Market Capitalisation as of May 15, 2024 (INR in crores) | CAGR of last 3 years (in %) | Sector Name |

| 1. | YES Bank | 67,968 | 20% | Banks |

| 2. | Zomato | 1,69,204 | N/A | E-Commerce/App based Aggregator |

| 3. | Vedanta | 1,62,365 | 17% | Mining & Mineral products |

| 4. | AU Small Finance Bank | 46,279 | 10% | Banks |

| 5. | Macrotech Developers | 1,18,285 | 54% | Construction |

| 6. | Polycab India | 97,173 | 59% | Cables |

| 7. | Samvardhana Motherson | 85,654 | 0% | Auto Ancillaries |

| 8. | Suzlon Energy | 56,957 | 101% | Capital Goods – Electrical Equipment |

Conversely, the weights of Dabur, ICICI Lombard General Insurance Company, Jubilant Foodworks, and PI Industries have decreased.

| Serial No. | Securities Name | Market Capitalisation as of May 15, 2024 (INR in crores) | CAGR of last 3 years (in %) | Sector Name |

| 1. | Dabur | 96,753 | 1% | FMCG |

| 2. | ICICI Lombard General Insurance Company | 81,516 | 4% | Insurance |

| 3. | Jubilant Foodworks | 31,065 | -6% | Quick Service Restaurant |

| 4. | PI Industries | 55,289 | 11% | Agro Chemicals |

The changes in the indices will be effective from 31 May 2024. After the update, India’s net stock count in the MSCI Standard/EM Index will be 146.

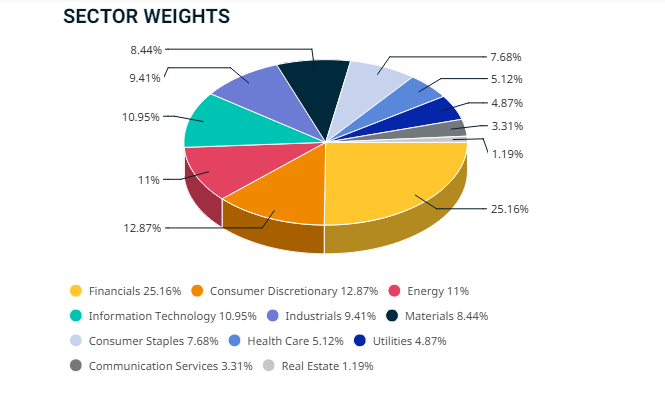

Sector-wise weights of different sectors listed in the MSCI India Index

Equitypandit brings you Unicorn | The Super App for Indian Stock Market, where you can find 103+ tools for and 10x your trading and investing journey.

You can get easy access to the platform as it is available on Android, iOS and Web as well.

Check out Unicorn Signals Now.