US Treasury Secretary Janet Yellen sent a letter to Congress on May 1 warning that if no action is taken to raise the US debt ceiling, the government may be unable to pay its obligations after June 1.

So, is the world’s largest economy about to run out of money and what is this “Debt Ceiling”?

Let’s try to decode the US’s situation and assess its potential impact on the rest of the World.

US Debt Ceiling – the $31 Trillion Question

Like every other country, The US charges taxes to the citizens to pay for the country’s bills. This includes federal employees and armed forces salaries, interest on the national debt, social security and Medicare payments and everything else required to run the economy.

Usually, the US government spends more than it earns. This is known as a deficit. Over the last decade, the US deficit ranged from $400 billion or $3 trillion each year.

To compensate for the deficit, the government borrows money from investors, banks and even other countries via bonds. According to the January 2023 Treasury Report, Japan and China hold nearly $1100 billion and $860 billion, respectively, in US bonds.

To curb over-borrowing, the US Congress implemented the Debt Ceiling in 1917. It limits the amount the country can borrow to fulfil its financial and economic obligations. Only the US and Denmark have a debt ceiling.

This barrier began at roughly $40 billion and has since risen to $31.4 trillion. It has been hiked 20 times in the previous 20 years. On January 13, 2023, the existing ceiling had already been attained.

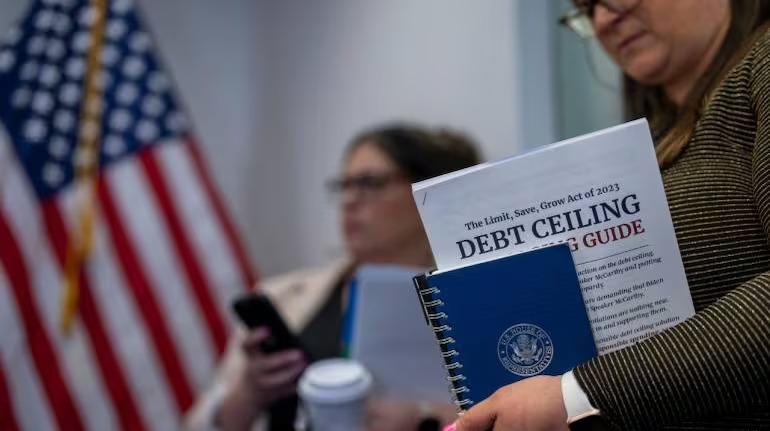

When the ceiling is broken, the US Congress must determine whether to raise or suspend the limit in order to keep the country from defaulting on its debt.

The closest it came to default was in 2011 when Congress enacted a measure to increase the debt ceiling only 72 hours before the Treasury’s deadline. This was also the only occasion the country’s credit rating was reduced.

The representatives of both houses have been constantly meeting to decide whether to raise the limit or deduct the government’s spending. The crisis is turning out to be a Political Debacle rather than a financial catastrophe.

A Financial Political Crisis?

The Republicans and the Democrats don’t get along all that well. Usually, they unanimously decide if the bill regarding raising the debt ceiling has to be passed, with 2011 as an exception. Since 1960, the debt ceiling has been raised 49 times under Republican Presidents and 29 times by the Democrats. This time, with Joe Biden being a Democratic President, the Democrats get the opening negotiation. But what is the debate?

The Republicans are ready to agree to raise the ceiling if the Democrats accept to reduce spending and cut costs. Republicans want to increase and strengthen job requirements for non-disabled persons who seek entitlements and assistance. They want to recoup cash authorised for COVID-19 assistance but not yet spent. Another demand is for cuts to clean-energy subsidies under the Inflation Reduction Act. They also determined that any deal must include spending caps.

The Democrats want to raise the debt ceiling and consider spending cuts thereafter. Representatives from both houses hope to reach an agreement by the end of the week. However, the ongoing “will they or won’t they” between the parties could make investors wary of the country.

What if the US Defaults?

The US has never defaulted before. President Biden and Kevin McCarthy, Speaker of the United States House of Representatives, both understand the seriousness of the matter as we approach the June 1 X-date. Both have comforted US citizens by assuring them the US will not default on its debt. But what if?

What if the largest economy in the world defaults?

What if the US could not repay its nearly $32 Trillion debt?

What would happen in such a circumstance is unknown. But it would be disastrous. Yellen believes that failing to meet the legal obligations would cause irreparable damage to the country, its citizens, and possibly the world.

Imagine if the US government could not take action before the X-date. Let’s try to assess what worse would happen next.

The first target would be Federal Employees and Dependent US Citizens. People from Federal clerks to the armed forces would get no paychecks for some time. Citizens dependent on Social Security Benefits, Patients waiting for Medicare payments, or students hoping to get loan forgiveness would all suffer next. A total of 7 million jobs are expected to be eliminated.

The investors will know that the US cannot return the borrowed money. The country’s credit rating would downgrade, implementing a hike in federal interest rates. People would lose faith in the US dollar, and its value would slide. Mortgage rates would probably soar, tanking the housing market.

The wound would then spread across the financial markets. The country might see a crash of the same magnitude as the 2008 Lehman Crisis, if not worse. Gold prices could potentially benefit from the crash and would reach new highs.

The US could go into recession and take down other countries. If the US defaults, the world will roll into a Global Catastrophe unlike anyone has ever seen. Keep in mind; these impacts might be exaggerated to depict the gravity of the situation.

All we can do is hope that Congress resolves its internal issues and stops playing Russian Roulette with the country’s fate.

Signals, Powered By EquityPandit

Signals, Powered By EquityPandit