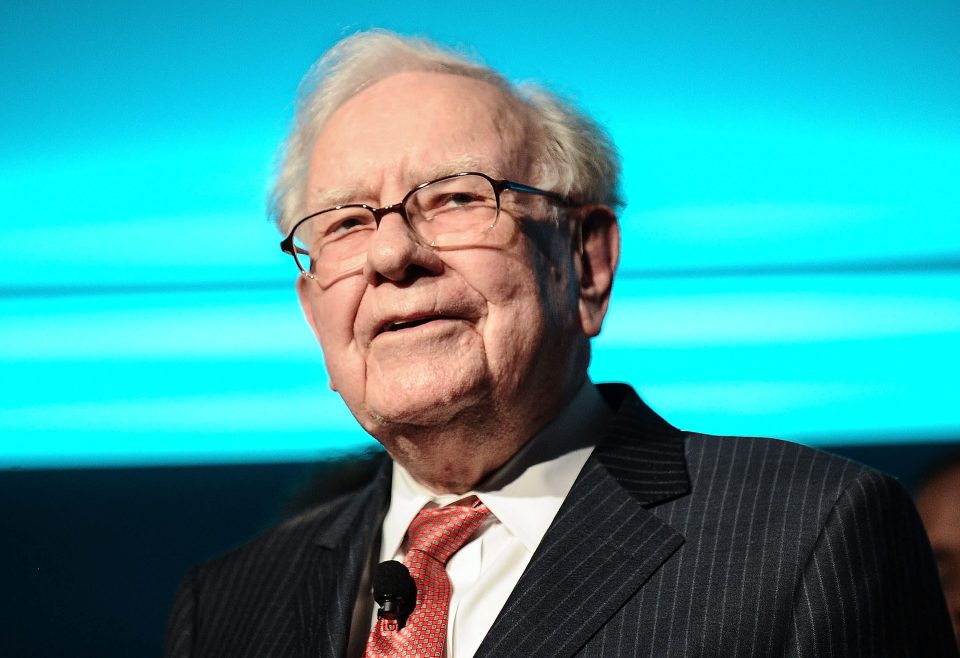

According to the US Securities and Exchange Commission (SEC) filings, Warren Buffett’s firm Berkshire Hathaway dumped a net $8 billion worth of shares during the April-June quarter of the current fiscal year.

The second-quarter earnings report of Berkshire Hathaway showed that the company sold close to $13 billion worth of shares and bought shares worth less than $5 billion during the period.

The company dumped $13.3 billion worth of stocks in the previous quarter. This concerned investors that the US economy, which is already slowing, might be heading towards a recession.

The Oracle of Omaha’s company spent only $1.4 billion in buybacks in the June quarter. The same number for the first financial quarter 2023 was $4 billion. The sell-off led to a 13% increase in the company’s total cash and treasury to a near-record of $147 billion between April and June.

Warren Buffett is widely followed by investors worldwide, and his decisions are analysed closely to determine the future of the markets. Many analysts expressed their views on the move. They believe this sell-off marks a significant departure in his tone and positioning towards US equities.

Some say that Buffet knows that cash is king when a recession is approaching. The move by the ace investor suggests that the US economy is still in the doldrums, despite consistently slower inflation.