Diwali is near, and soon we will see muhurat trading, a special one-hour market session held on the day of the festival. This year, the session is scheduled on October 21, 2025, from 1:45 PM to 2:45 PM IST. During that hour, many traders enter the market for symbolic reasons and to take new positions. While this session impacts derivatives markets, how does the broader Diwali sentiment affect derivatives trading? Let’s understand in this article.

Impact of Diwali on derivatives

Around the Diwali period, several factors tend to influence how derivatives (futures and options) behave. Here are the factors:

1. Muhurat Trading-led High Volatility

Even though Muhurat Trading is largely ceremonial, it often brings noticeable price swings in that short span. Because the session is tightly time-bound, bids and offers converge quickly. Some stocks may spike or drop sharply as traders rush to execute orders.

In derivative markets, these underlying swings amplify. For instance, if a blue-chip stock surges 2% in an hour, its futures contract may surge more due to leverage, and option deltas can magnify the effect.

Many traders consciously try to exploit these micro moves for arbitrage or intraday profits.

Still, most participants enter with optimism and expect gains. That positive bias can act as a self-fulfilling momentum in many cases and push prices upward in that short window.

2. Overall Bullish Sentiment

The festive mood tends to infuse markets with optimism.

Historically, markets have been more positive around Diwali periods. That optimism leaks into derivatives: traders may take bullish positions (e.g. buy call options or go long futures) expecting the upward drift. The implied volatility of calls may rise in anticipation.

In effect, derivative markets may get skewed toward bullish trades. For example, if traders see strong demand for call strikes, the call option premiums may inflate relative to puts, even if the broader market is quiet.

3. Increased Participation from Retail & Institutional Traders

Months around Diwali often attract more retail participation as many want to symbolically trade at the beginning of the Hindu year, which can be visible on NSE and BSE option chains. The same goes for institutions that may open positions or hedge existing ones during the symbolic session.

Derivative volumes, especially in index futures and options, may see an uptick relative to an otherwise off-peak period.

How to Navigate Diwali F&O Trading

Participating in F&O during Diwali, especially the special Muhurat session, requires more caution than usual. The limited trading window and festive sentiment can make conventional strategies riskier.

Below are key strategies to help you trade more confidently in this period.

1. Hedging to Protect Your Portfolio

Hedging means placing a protective position so that if your core holdings suffer a drop, the loss gets cushioned rather than wiped out.

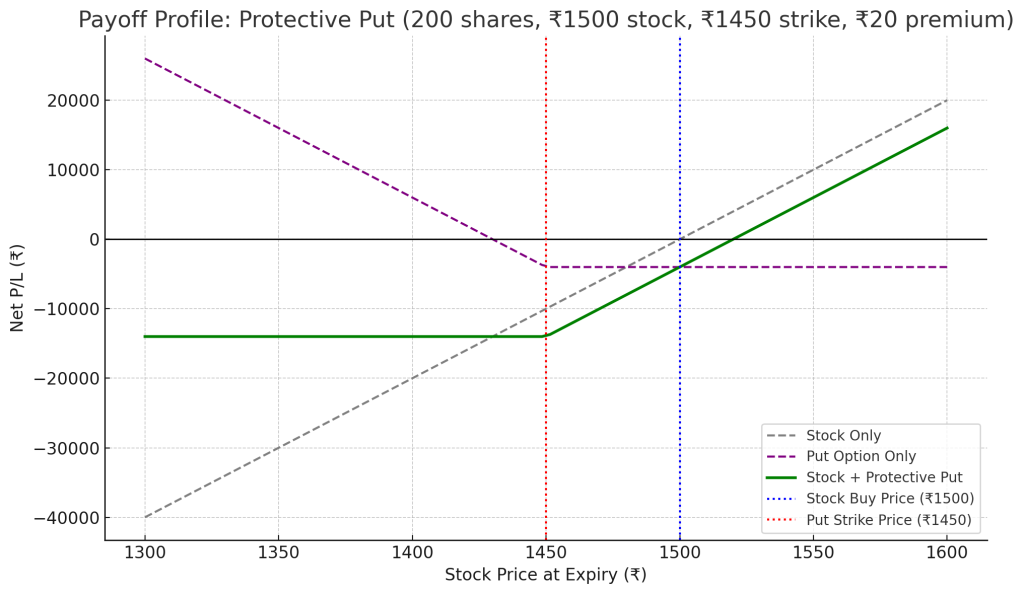

Suppose you own 200 stocks of a Sensex company, which is trading at ₹1,500, and you worry that Diwali‐season volatility could make it tumble. You could buy a put option with a strike price of ₹1,450 by paying a premium, giving you the right to sell at ₹1,450 even if the market falls below that.

The payoff structure below shows how this hedge works across different price scenarios:

As the graph illustrates, once the stock price dips below ₹1,450, your losses do not keep increasing. The put option kicks in and limits further damage, locking your minimum exit at ₹1,450 minus the premium. This means even if the stock crashes to ₹1,300, your loss is capped.

On the other hand, if the stock rises above ₹1,500, your gains continue, although slightly reduced by the cost of the premium. In effect, the hedge acts like an insurance policy.

It helps you stay invested without exposing your portfolio to a steep downside, which is especially valuable in choppy markets that often follow holiday trading sessions.

2. Taking Controlled Short Positions in Stock Futures

In periods when market sentiment turns wary, taking a short futures position in a weakening stock can be a way to profit from anticipated declines, provided you maintain tight control over risk.

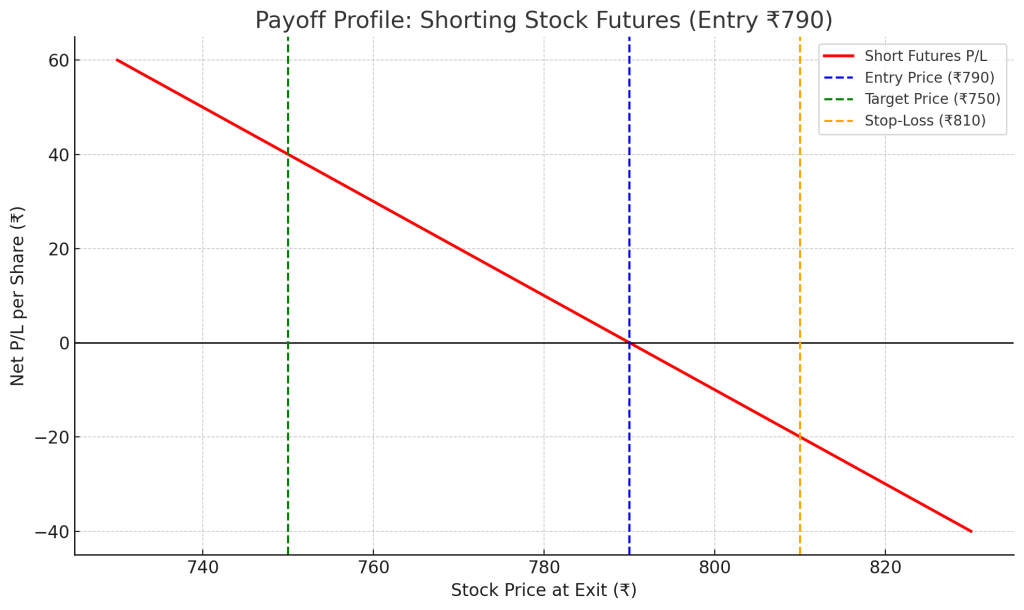

For example, imagine stock “Y” has been steadily dropping and breaks below its support level of ₹800, while open interest in its futures contract is rising (a sign that more participants are building short bets).

You might sell (short) one futures lot of “Y” at ₹790 per share, expecting it to fall to ₹750. If it does, you buy back and pocket the difference.

The chart below illustrates the profit and loss behaviour of this short futures position at various closing prices:

The graph shows that your profit grows as the price moves lower than your entry level of ₹790. If it falls to ₹750, you earn ₹40 per share on the trade. This works because short selling allows you to sell first and buy back later at a cheaper price.

If the price climbs above ₹810, your loss starts to build up, which is why a strict stop loss is essential.

Unlike buying a put option, where the premium limits your risk, shorting futures has no natural cap on losses. This makes disciplined position sizing and timely exits critical, especially during the Diwali period when sudden reversals are common.

3. Writing Calls for Income Generation

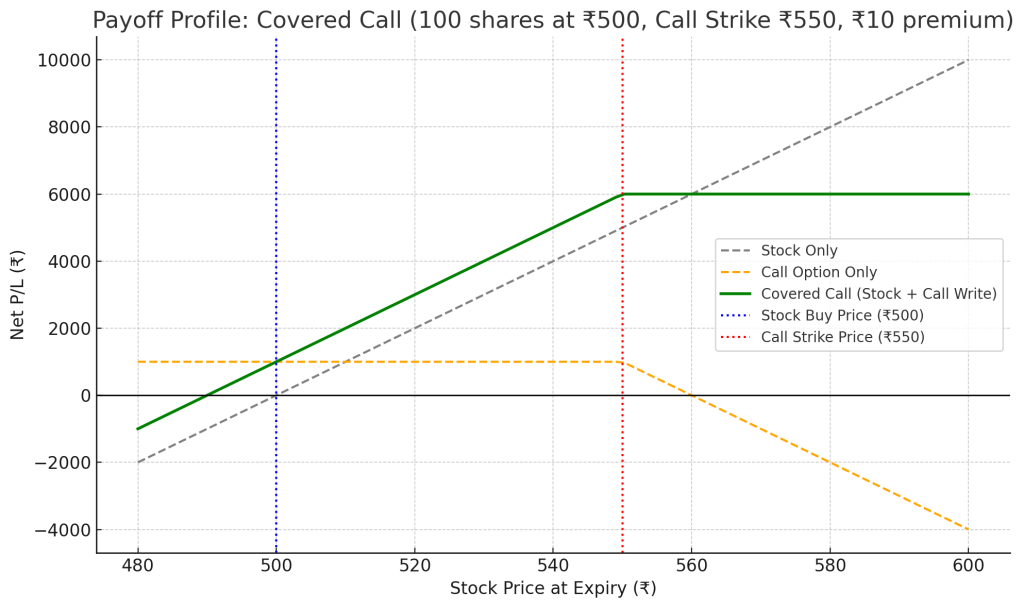

If you already hold shares and believe the stock price is unlikely to rise sharply in the short term, selling a call option on those shares can help you earn additional income.

For example, imagine you own 100 shares of XYZ at ₹500 each. You sell a call option with a strike price of ₹550 and receive a ₹10 per share premium. If the stock remains below ₹550 by expiry, the option will expire worthless, and you keep the ₹1,000 premium as income.

However, if the stock moves past ₹550, say to ₹580, you are obligated to sell your shares at ₹550, which limits your upside gain. You still retain the premium, but you miss out on any additional rally above the strike price.

The chart below helps illustrate how your profits change as the stock price moves at expiry:

As the chart shows, your profit increases along with the stock price up to ₹550. Beyond that point, gains no longer grow because you have agreed to sell your shares at ₹550. The ₹10 premium provides an extra boost to your return, even when the upside is capped.

On the downside, if the stock price falls below ₹500, your losses begin to accumulate, but the premium received helps soften the impact slightly.

This makes the covered call a useful strategy when you expect stable or mildly bullish conditions and want to earn income without taking on much additional risk.

4. Employing Option Spreads & Combination Strategies

In times of uncertainty, using option spreads helps you take a position with defined risk and controlled payoff rather than betting everything on a single call or put.

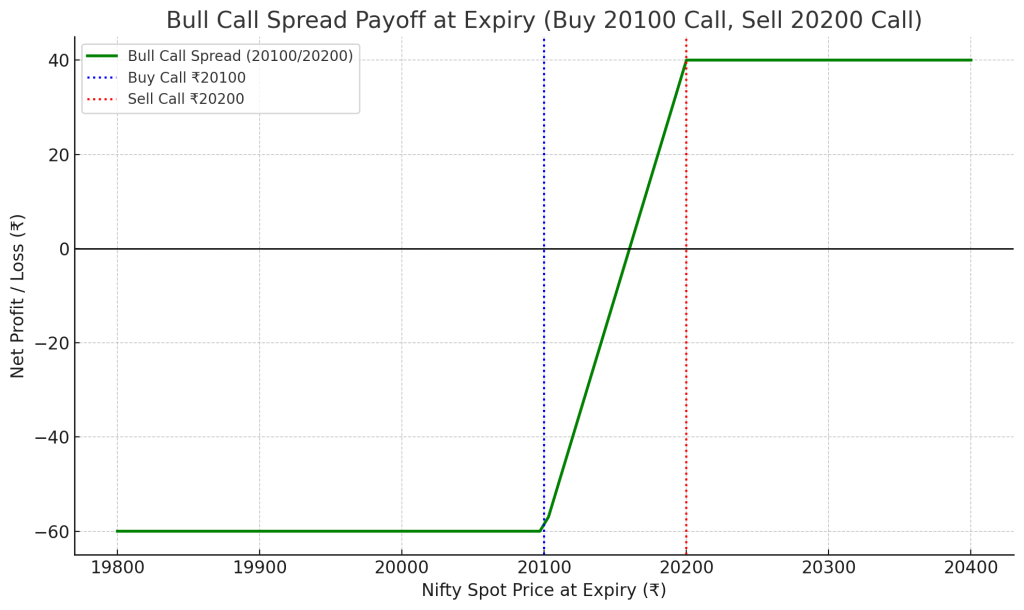

For instance, imagine Nifty is at 20,000 and you expect modest movement, so you buy a 20,100 call and simultaneously sell a 20,200 call (both same expiry). This is a bull call spread. Your upside is limited from 20,100 to 20,200, and your maximum loss is just the net premium paid.

The visual below shows how this spread behaves across different expiry prices:

As the chart shows, your maximum loss is limited to the net premium paid when the index closes below 20,100.

If the index settles between 20,100 and 20,200, you earn partial profits. Above 20,200, the gains are capped since the short call starts to reduce the long call’s benefit.

This structure gives you a clearly defined risk and reward range, which is ideal when you’re expecting only a small upward move in the market during the festive period, not a sharp rally.

Conclusion

Diwali often brings a shift in trader sentiment, liquidity, and market activity. While patterns vary year to year, understanding their subtle impact on derivative trading helps in making informed decisions. Staying aware of festive season dynamics can give traders a thoughtful edge for derivatives trading during this period.

Live

Live