979.55

(4.89%)

45.65

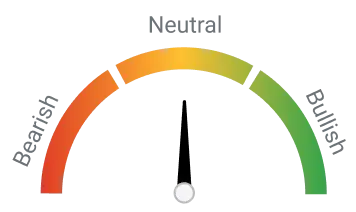

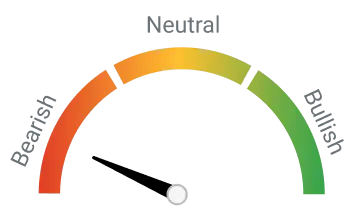

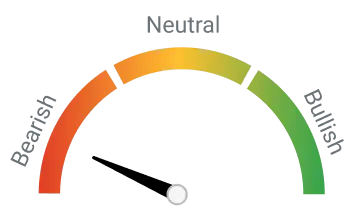

AURIONPRO Performance

Short Term Investors

Medium Term Investors

Long Term Investors

₹1,00,000

--

--

--

979.55

(4.89%) 45.65| Pivots | Classic | Fibonacci | Camarilla | Woodie's | Demark's |

|---|

| Indicator | Value | Action |

|---|---|---|

| Loading... | ||

| Indicator | Value | Action |

|---|---|---|

| Loading... | ||

| Period | SMA | EMA |

|---|---|---|

| Loading... | ||

| Duration | Returns |

|---|---|

| Loading... | |

| Name | Designation |